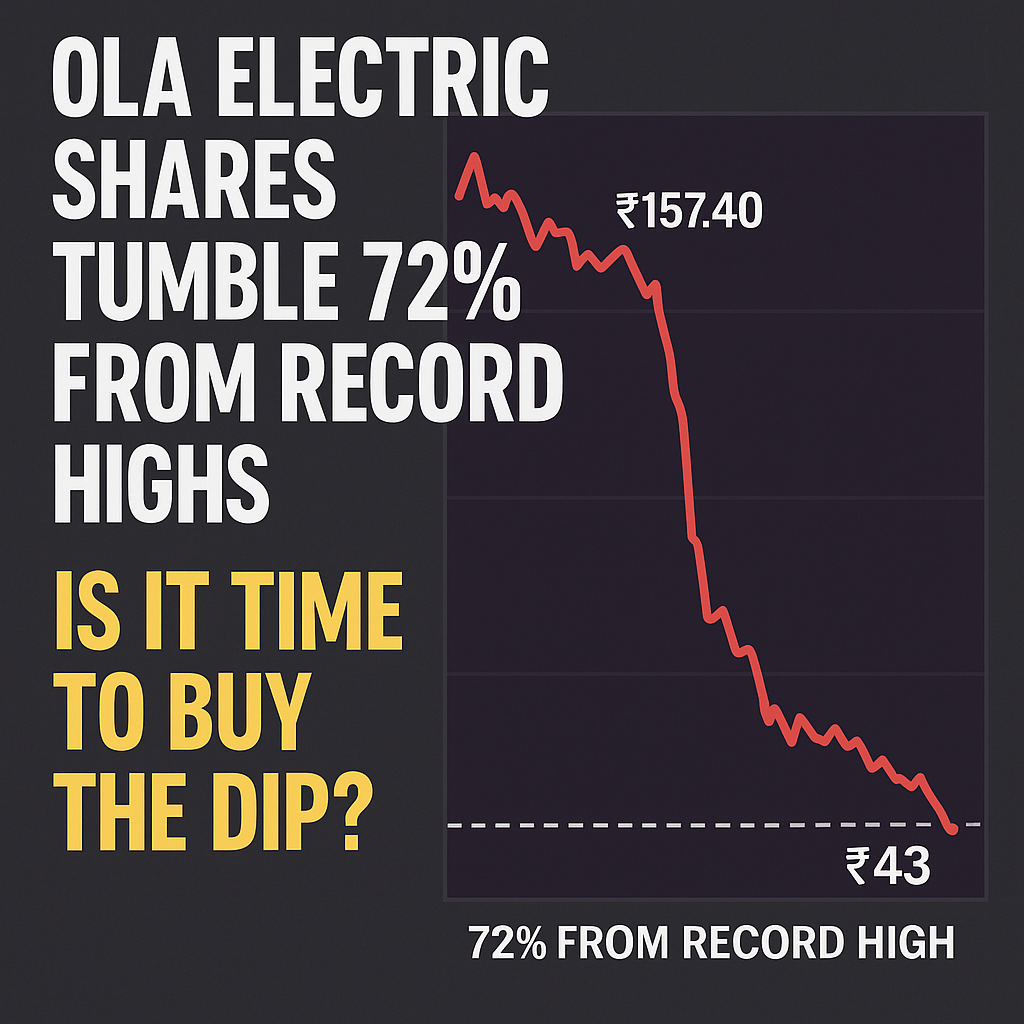

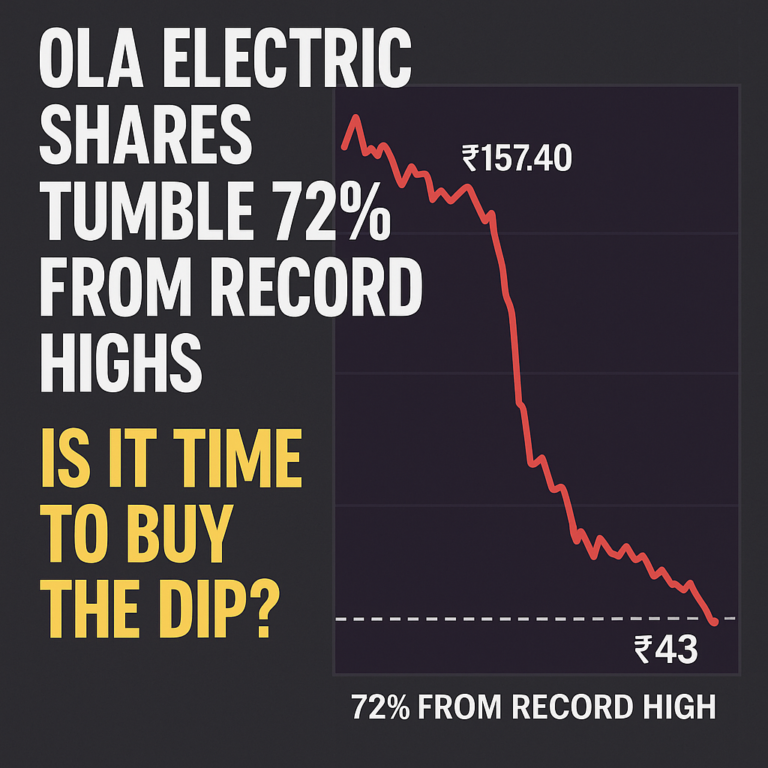

Shares of Ola Electric Mobility have crashed approximately 72% from their record-high of ₹157.40 reached on August 20, 2024, closing near ₹43 on June 24, 2025. The decline follows weak Q4 earnings, declining deliveries, and large block trades that rattled investor confidence.

🏦 What’s Behind the Drop?

1. Disappointing Q4 FY25 Results

The company posted a net loss of ₹870 crore, more than double its loss from the previous year. Operating revenue dropped 62% YoY to ₹611 crore, and deliveries fell to 51,375 units from 1.15 lakh units in Q4 FY24.

EBITDA margin slipped drastically to –78.6%, while consolidated EBITDA stood at –101.4%.

2. Block Trades & Institutional Exit

A large block deal involving 0.8% of equity (~₹731 crore) sent the stock tumbling. Reports suggest Hyundai Motor exited during this trade, further denting market sentiment.

3. Technical Breakdown

The stock fell below key exponential moving averages (EMAs) and touched an RSI of 30, indicating an oversold zone. However, it also signals high volatility and uncertainty ahead.

📊 Reaching a Make-or-Break Zone? What Analysts Say

- Support Level: Analysts see the ₹42–₹45 zone as crucial. If this breaks, the next downside could go toward ₹30–₹25.

- Resistance Level: A bounce back above ₹56 may indicate accumulation and reversal trends.

- 12-Month Outlook: Trendlyne data shows a mixed analyst view: 2 Strong Sell, 1 Sell, 2 Hold, 1 Buy, and 1 Strong Buy, with a median target of ₹59 (35% potential upside).

🛑 Market Sentiment Snapshot

- Retail Mood: Turning cautiously optimistic, with bargain buyers eyeing rebounds.

- Social Buzz: Mixed views on platforms like Reddit and Stocktwits; retail investors are skeptical while some believe a bottom may be near.

Quote from a Reddit thread:

“This stock had a market cap of ₹65,000 Cr last year. It’s below ₹22,000 Cr now. Might test ₹30 soon.”

🔍 Should You Buy the Dip?

📈 Bull Case:

- RSI indicates oversold zone, possible short-term rebound.

- Average analyst target of ₹59 offers 35% upside.

- Gross margin improved to 19.2% due to better cost structure from Gen-3 scooters.

📉 Bear Case:

- High and widening losses remain a concern.

- Further promoter exits or block deals may trigger fresh downside.

- Regulatory issues and after-sales service gaps still unresolved.

Verdict: High-risk scenario. Only suitable for aggressive investors with a tight stop-loss near ₹42.

📅 Ola Electric’s Q4 & FY25 Performance Breakdown

Q4 FY25:

- Net Loss: ₹870 Cr (vs ₹416 Cr YoY)

- Revenue: ₹611 Cr (down 62% YoY)

- Deliveries: 51,375 (vs 1.15 Lakh YoY)

- Auto EBITDA Margin: –78.6%

- Consolidated EBITDA Margin: –101.4%

- Gross Margin: 19.2% (boosted by Gen-3 scooter models)

FY25:

- Deliveries: 3.59 Lakh units (vs 3.29 Lakh FY24)

- Revenue: ₹4,665 Cr

- Consolidated EBITDA Margin: –34.6%

🔎 What Should Investors Track Next?

- Price Behavior around ₹42–₹45 zone

- Block Deals and promoter activity

- Monthly Sales Data and delivery recovery trends

- Regulatory Announcements or EV subsidy changes

🚀 Long-Term Outlook

Despite the near-term headwinds, Ola Electric still has potential long-term advantages:

- EV market expansion in India

- Continued R&D in Gen-3 and Gen-4 scooter platforms

- Possible rebound once losses stabilize and margin improves

However, investors should not ignore the execution challenges and capital expenditure pressures.

✅ Final Word: Risky but Potentially Rewarding

If Ola Electric can stabilize deliveries and reduce cash burn, the stock might recover in the next few quarters. But with technicals pointing south and earnings disappointing, it’s not yet time for heavy accumulation.

Investor Tip: Wait for confirmation of reversal above ₹56 or consider small exposures near strong support levels.

+ There are no comments

Add yours